-

How to Use the MSR in Your Inventory Workflow

When new features are available, it may not be evident how the feature should be added into an existing workflow. At Aligni, we get it. That’s why we’re walking through an example workflow for our…

-

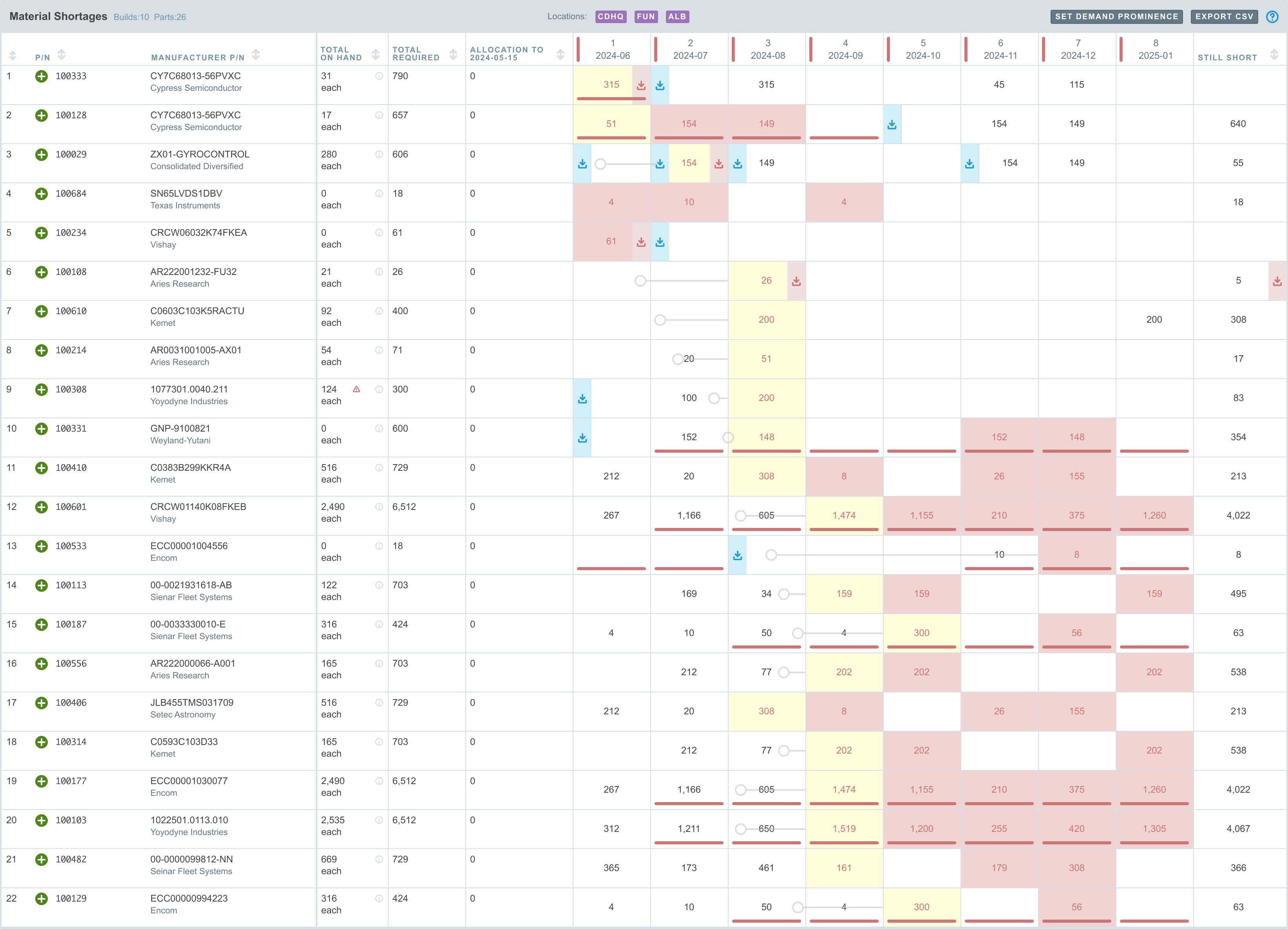

Reducing Shortages through Better Information and Process Management

When part and material shortages happen, it can be embarrassing as well as expensive. As a company begins to juggle multiple production jobs, shortages have an even greater potential to occur. The way to escape…

-

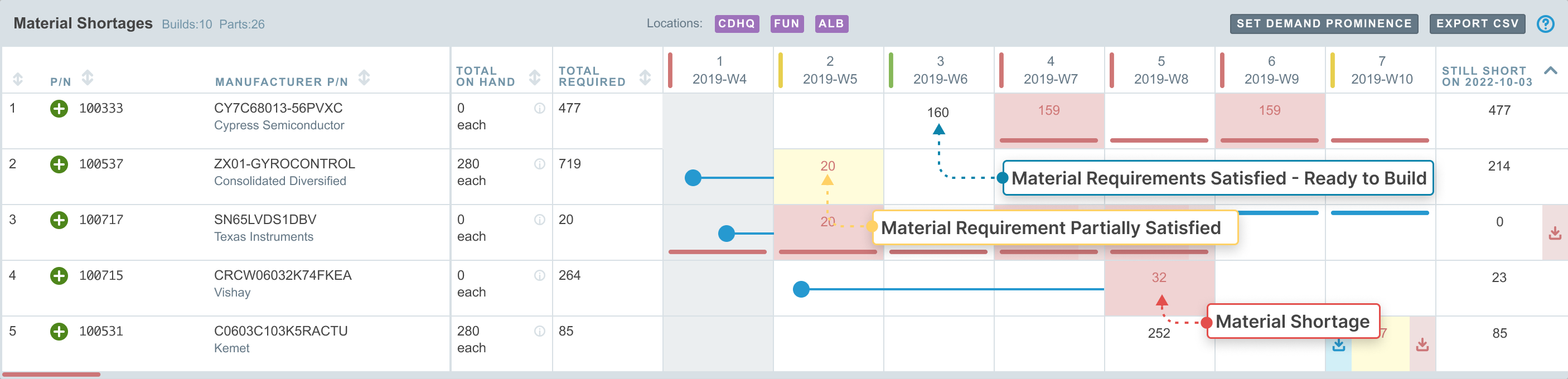

Making the Buyer/Planner Role Work with Aligni

A Buyer/Planner has to manage two important aspects of the manufacturing process: purchasing and production scheduling. At larger companies, these operations are done by at least two people, full time. That means the person doing…

-

Aligni Recommends: How to Get Your PCB Manufactured and Assembled

Going beyond just getting a PCB made, Phil’s Lab steps through the process of getting your files ready for placing a fully-manufactured electronics production run. Starting with the project in Altium Designer, he walks through…

-

Aligni Recommends: How to Manufacture a New Electronic Product Video

Expanding on our A gentle introduction to electronics contract manufacturing blog post and a highly detailed EMS plant tour video, we share Predictable Designs’ How to Manufacture a New Electronic Product video.

-

Aligni Recommends: Walking through a Big PCB Factory in China | JLCPCB

We’ve been talking about working with EMS providers on this blog for a while now. The conversation has been revolving around what it takes to start getting your project built by an electronics contract manufacturer.…

-

Quality, Capacity, and Capability: Finding the Best EMS Provider for Your Organization

If you’re looking to get into outsourcing your electronics products or just a few subassemblies, then it’s time to step up to purpose-built software to more effectively manage the process, as well. It’s time to…